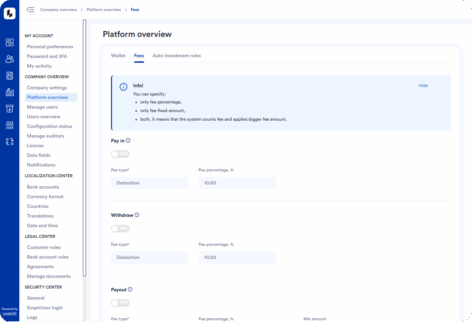

To make sure your business is rewarded properly, you can set up fees at any point within the transaction flows.

From successful raise fees, to withdrawals, top-ups and other actions on the platform, you have a great opportunity to monetize your business.