Revolutionize investment market with robust P2P lending software

Explore the complete peer-to-peer lending automation software to take your business to the next level. With the LenderKit debt crowdfunding software, you can easily onboard users, close more deals and facilitate transactions.

- Real estate lending software

- P2P lending solution for SMEs

- Launch a microloan platform

- Start a debt crowdfunding portal

- Explore loan management software

Grow your peer-to-peer lending business in three simple steps

Pitch to stakeholders with a prototype

Launch a P2P lending platform prototype and pitch to investors or board of directors to raise capital for further platform development. LenderKit offers a Basic peer-to-peer lending software solution which allows you to start a simple platform and have an asset to show to investors.

Test your business model with an MVP

Use white-label P2P lending software to automate operations and grow your online lending business. With the LenderKit’s Pro tier, you’ll get a fully-scalable peer-to-peer lending platform and outperform your competitors.

Launch a full-scale P2P lending platform

While using off-the-shelf software allows you to start quickly, you may outgrow the P2P lending software at some point, so you’ll need a more robust platform. With the Enterprise package, our team can easily develop your platform to make it truly unique.

P2P Lending software for your needs

LenderKit is your comprehensive solution for building and growing a distinctive P2P lending or debt crowdfunding platform. The peer-to-peer investment software comes with a user-friendly interface to ensure a seamless experience for lenders and borrowers.

The platform allows you to effortlessly manage the entire lending lifecycle, from origination to repayment, with support for various loan types. Prioritize security through advanced encryption for sensitive financial data.

- Full-cycle loan automation

- Credit scoring via third-party

- Faster KYC/AML verification

- Loan calculator

- Payment processing automation

- Investor and borrower portal

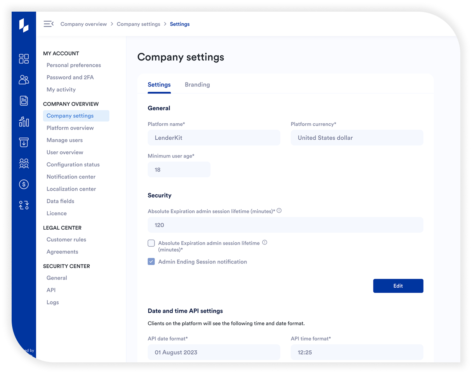

- Fully-fledged admin backoffice

What features does LenderKit offer?

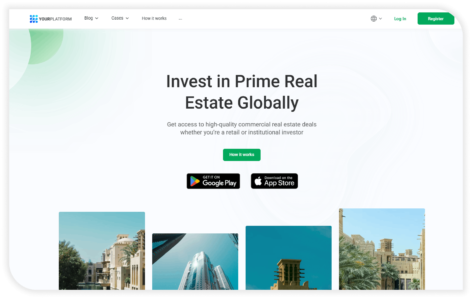

Launch a debt crowdfunding website

Explore the pre-built P2P lending website layout which you can quickly customize, upload your content, images and contact information and start attracting users.

Create a fresh and professional-looking website for your debt crowdfunding portal to enter the P2P lending market in no time.

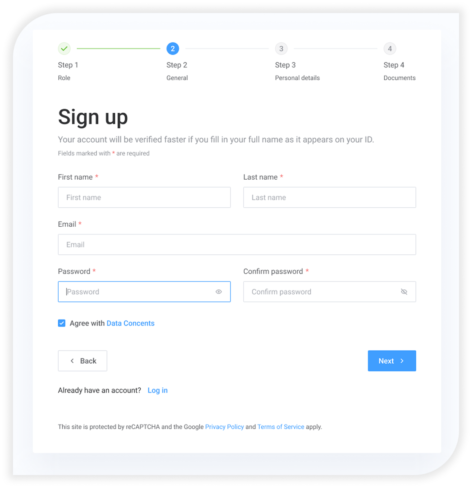

Automate onboarding of investors and borrowers

Set up a debt crowdfunding portal for your investors and borrowers where they can manage payments, campaigns, investments, personal information, connect wallets, cards and more.

When users register on your P2P lending platform they’ll go through a KYC/AML optimized registration form and provide the details required for verification.

The user verification process can be automated with a third-party KYC/AML provider or your compliance team can process new requests manually.

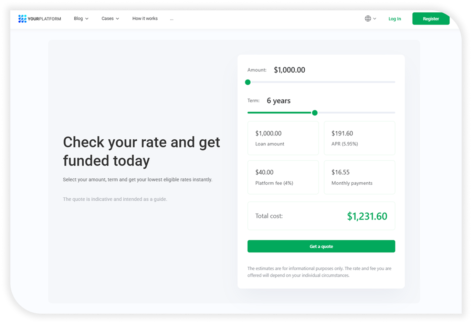

Leverage best practices when sourcing deals online

Borrowers can get a rough quote based on your platform’s rates and create offerings automatically which the admin of the platform can approve or decline.

Allow SMEs and real estate developers to apply for a loan with a pre-built loan calculator on your P2P lending website.

Use flexible debt crowdfunding software

Automate full-cycle loan management with a powerful back-office which allows you to:

- Manage lending and investing campaigns

- Manage wallets, repayments, auto-investing, and more

- Allow investors to trade bonds in the secondary market

- Integrate CRM, marketing automation, KYC/AML, eSign, currency exchange, crypto, and payment processing with LenderKit as per your request

- Set up new user roles for advisors, loan managers, compliance managers, etc.

FAQs

What is LenderKit P2P lending software and how does it work?

LenderKit offers white-label P2P lending and debt crowdfunding software that helps businesses launch and automate online lending platforms. It supports investor and borrower onboarding, KYC/AML checks, loan origination, repayment tracking and complete back-office management.

Which types of P2P lending or debt crowdfunding platforms can be launched with LenderKit?

We can set up P2P lending platforms for real estate, SME financing or niche debt crowdfunding models. Apart from P2P lending, LenderKit also provides equity crowdfunding, so you can combine multiple models in one platform.

What is the difference between the Basic, Pro and Enterprise packages?

The Basic package helps you launch a P2P lending prototype for early investor onboarding and pilot project crowdfunding. The Pro package provides a ready-to-use, scalable MVP to test your business model further. The Enterprise package offers full custom development for regulated, fast-growing lending platforms.

Does LenderKit include investor and borrower portals?

Yes. LenderKit provides dedicated portals for investors and borrowers, allowing them to manage payments, investments, loan applications and personal profiles in one place.

How does KYC/AML verification work on the platform?

LenderKit includes built-in KYC/AML flows that can be automated through third-party identity verification providers or handled manually by your compliance team. This ensures a secure and compliant onboarding process.

Can I integrate external systems like payment gateways, CRM, KYC/AML providers or crypto wallets?

Absolutely. LenderKit already integrated several payment gateways, KYC/AML providers and e-sign services. Additional integrations can be done on demand and include custom payment processors, CRM systems, e-signature tools, currency exchange services, KYC/AML providers and crypto payment solutions to streamline your lending operations.

What loan management features does LenderKit offer?

The software automates full-cycle loan management, including loan origination, campaign creation, repayments, wallets, auto-investing and secondary market trading. The admin back office provides full visibility and control over all transactions.

Is LenderKit suitable for real estate and SME lending platforms?

Yes. LenderKit is ideal for real estate lending, SME loans, and commercial debt financing. It includes loan calculators, deal approval workflows and flexible loan structures tailored for both property developers and small businesses.

Is the platform compliant with regulations in the USA, UK, EU or MENA regions?

LenderKit offers compliance-ready architecture and supports region-specific requirements. It is frequently used by platforms operating under FCA (UK), SAMA/CMA (Saudi Arabia), SEC (USA), and ESMA (EU)-aligned regulations.

How do I get started with launching a P2P lending or debt crowdfunding platform?

You can start by sharing your business requirements with the LenderKit team. Based on your goals, we’ll recommend the right package — prototype, MVP or full custom build — and guide you through demo, setup and deployment.