Investment management software for your business

Automate full capital raising cycle on your platform from investor onboarding and deal creation to investment management and fund disbursement.

- Private equity fund

- Debt investment platform

- Investor relations software

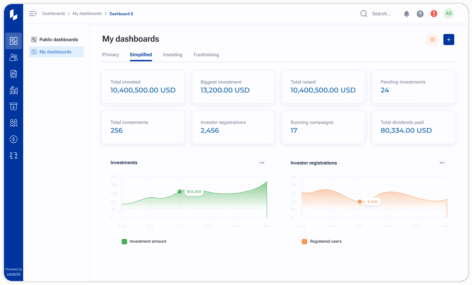

Admin back office for your investment platform

Organize your team depending on their responsibilities. Assign the required permissions to different staff members to mirror your existing corporate structure and business operations.

Your team will be able to:

- Manage deals and offerings

- Manage transactions

- Manage investors & fundraisers

- Sign and exchange documents

- Set up fees and commissions, etc.

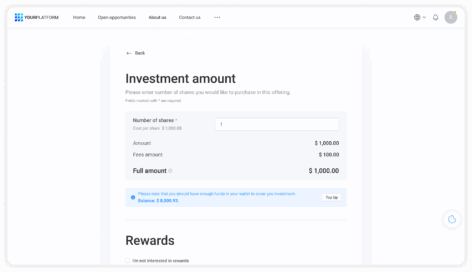

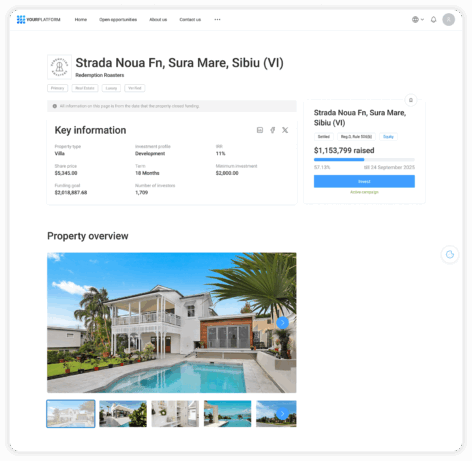

User-friendly investor portal

Allow investors to access your alternative investment platform and choose offerings to invest in. Some of the investor portal features allow investors to:

- Set up auto-investments

- View transaction history

- Manage wallets

- Browse and invest in offerings

- Communicate with a fundraiser, etc.

Alternative investment management software for your needs

Expand your existing operations

Enter the new markets with a powerful investment management automation tool to grow your customer base and market share.

Start a new investment management platform

Launch a fresh investment management platform and pitch to the board to raise funds or present to the regulator for compliance.

Migrate from your current software provider

Feel like you’ve spent a lot of resources with your current provider but haven’t moved an inch? Try LenderKit to restart.

Adapt to any regulation

Alternative asset management platforms powered by LenderKit operate under various regulations in the USA, UK and the MENA region.

Our team will tailor your investment management software to fit the required compliance framework.

- Regulation CF

- Regulation A/A+

- Regulation D

- FCA (UK)

- SAMA/CMA

Integrate online payments

Streamline payment processing on your platform and enable:

- Automated payment processing

- Compliant fund management

- Custom repayment rules

- Card transactions and wire transfers and more

As a white-label investment platform, LenderKit already connected tools like Lemonway, Mangopay, NorthCapital and Hyperpay to empower your investment platform. Additionally, we could explore custom integrations and enable them for your platform.

Structure capital stack

LenderKit allows you to combine debt, equity and donation investment flows in one platform.

This should help you structure the investments and provide more diverse offerings to your investors and companies that raise capital on your crowdfunding platform.

FAQs

What is LenderKit investment management software and how does it help my business?

LenderKit is a white-label investment management software designed to automate the full capital-raising cycle. It streamlines investor onboarding, deal creation, campaign management, transactions, compliance flows, and investor reporting — helping you scale operations efficiently.

Which types of investment platforms can I build using LenderKit?

You can launch private equity portals, debt investment platforms, donation-based platforms, fund management systems or hybrid alternative investment marketplaces.

Does LenderKit include an investor portal for managing investments?

Yes. The platform comes with a user-friendly investor portal where users can browse offerings, set up auto-investing, manage wallets, view transaction history, sign documents, and communicate with fundraisers directly.

What admin back-office features are available for investment management teams?

The admin back office allows your team to manage deals, track transactions, configure fees and commissions, approve investor applications, exchange documents, and assign user permissions to mirror your internal corporate structure.

Is LenderKit compliant with crowdfunding regulations globally?

LenderKit supports platforms operating under US (Reg CF, Reg A/A+, Reg D), UK (FCA), Europe, (ESMA – ECSPR) and MENA (SAMA/CMA) compliance frameworks. Our team tailors the software to your jurisdiction’s regulatory requirements to ensure a compliant operation.

Can I integrate third-party systems with LenderKit?

Yes. LenderKit already integrates with online payment gateways, KYC/AML tools and e-signature providers. Additionally, custom tools can be integrated on demand to streamline your investment management operations.

Can LenderKit replace or migrate data from my current investment software provider?

Yes. If your current solution is limiting your growth, LenderKit can help you migrate and relaunch your investment platform with a more scalable, customizable and automation-ready system.

Is LenderKit suitable for both new investment platforms and established firms?

LenderKit supports startups launching new investment portals as well as established firms expanding into new markets or upgrading outdated systems. It scales with your business and adapts to complex operational needs.

How can I get started with implementing LenderKit for my investment platform?

You can start by requesting a demo or sharing your business requirements with our team. Based on your goals — launching a new platform, upgrading your current software or entering new markets — we’ll recommend the right setup and integration approach.