Private Equity Investment Software at Your Fingertips

LenderKit offers custom investment software that can be tailored for private equity investment firms that focus on real estate and startup capital raising. It’s a comprehensive private placements solution designed to streamline the entire match-funding process from investor onboarding to campaign management.

By automating investment operations, you can boost your private equity business performance, enabling swift pipeline movement and customer satisfaction.

- Automate private fundraising

- Digitize investment operations

- Increase performance

- Speed up soft launch or MVP

- Close more private equity deals

Investment software for private equity firms and alternative funds

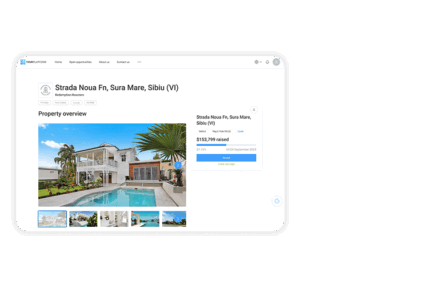

Source more deals seamlessly

Use LenderKit private equity software to facilitate deal sourcing through a dedicated website. Create robust campaigns and investment opportunities, attractive landing pages and portfolio propositions.

Empower investors and fundraisers

Allow fundraisers pitch you the deals for review and monitor campaign performance. Provide investors with a comprehensive portal to allocate interest in upcoming projects and invest in current opportunities.

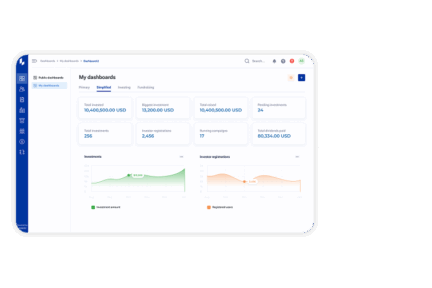

Access robust administrative capabilities

The admin area acts as the command center for managing operations. From overseeing campaigns to handling user data, transactions, and documentation, this centralized hub provides a powerful toolkit for effective administration.

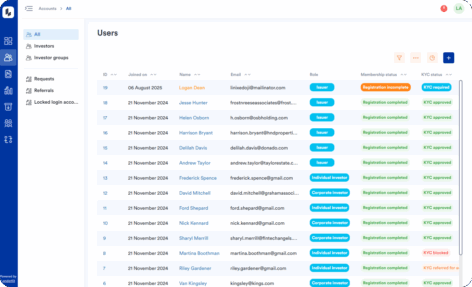

Manage investors and fundraisers on your private investment platform

Leverage LenderKit’s comprehensive investor management capabilities, including individuals and organizations. Gather the required information for user verification and allows your clients to create robust user profiles that they can use to invest through the platform.

Access insightful analytics, export any kind of information in the spreadsheet formats and make better business decisions to close more capital deals on a scale with the LenderKit private debt software or equity.

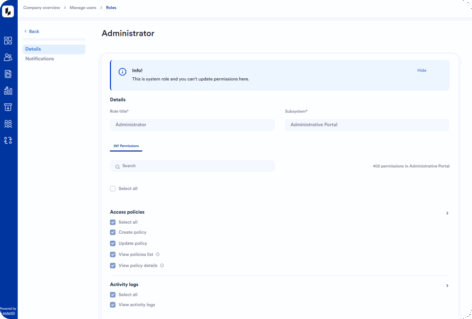

Create user roles to access and collaborate with your team

You can create advisor, investment manager, portfolio manager, lawyer or accountant roles and enable these user types to see only the information you want them to see.

The permissions module ensures that users in your organization get authorized access to sensitive and important data on your private placement platform.

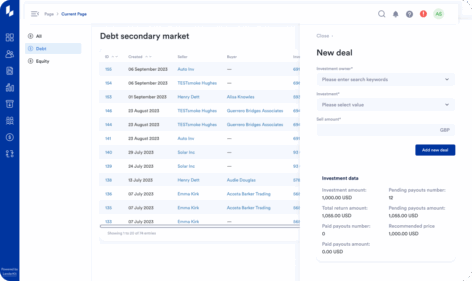

Enhance Liquidity with a Secondary Market

Offer secondary market liquidity on your private placements portal to introduce a new competitive advantage. By offering the secondary market functionality, you can allow investors to sell securities to other private investors to free some capital for other opportunities and campaigns listed on your platform.

Combine private equity and private debt investment flows

LenderKit provides multiple investment flows in one platform. So, LenderKit easily covers your private equity software needs as well as the private debt software functionality. Using LenderKit software, you can run both types of campaigns and offer diversified opportunities to your fundraisers and investors depending on your business model.

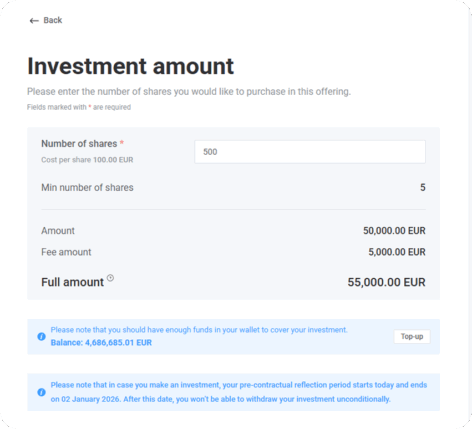

Automate money flows and integrate online payments

Integrations with online payment processors, custodians and escrow account providers allow you to automate fund disbursements, payouts and investments. LenderKit provides several ready-made private equity integrations with payment gateways, but we also allow for full customizability which means that you can either use a payment system of your choice or leverage basic invoicing.

With integrated solutions, you’ll be able enhance the entire investment experience while also:

- Funding deals faster

- Processing more transactions at a time

- Running private fundraising deals on a scale

- Automating KYC/AML verification

- Digitizing distributions

- Closing more deals online